47+ what are qualified mortgage insurance premiums

A lender must make a good-faith effort to determine that you have the ability to repay your mortgage before you take it out. The deduction for PMI cuts your taxable income by 1500.

5 Things You Did Not Know About Personal Loan Axis Bank

However even if you meet the criteria above the mortgage insurance premium deduction will be.

. Web What Are Mortgage Insurance Premiums. Web You bought a 200000 house put down 5 and paid 1500 in PMI premiums 125 times 12 months. This insurance requires two premiums.

Web Whether a person receives 600 or more of mortgage insurance premiums is determined on a mortgage-by-mortgage basis. An upfront fee of 175 of the loan value and an additional annual premium. A home includes a house condominium cooperative mobile home house trailer boat or similar property that has sleeping cooking and toilet facilities.

The 2 is based on the lesser of your homes appraised value or the maximum lending limit currently 970800 for 2022. 100000 50000 if married filing separately. Web Each FHA loan requires both an upfront premium of 175 of the loan amount and an annual premium of 045 to 105.

Web For this reason all FHA mortgage borrowers must obtain mortgage insurance. Once you have paid down the mortgage enough that it is less than 80 percent of the value of the home 78 percent in. Depending on the mortgage this can range from 045 to 105 of the loan.

Web The mortgage insurance premiums will be included on depreciation reports but wont flow to the Schedule A automatically. Web Mortgage insurance lowers the risk to the lender of making a loan to you so you can qualify for a loan that you might not otherwise be able to get. Web The premiums for the policy are included in your monthly mortgage payment.

Web The mortgage insurance premiums will be included on depreciation reports but wont flow to the Schedule A automatically. Web Qualified mortgage insurance is mortgage insurance provided by the Department of Veterans Affairs the Federal Housing Administration or the Rural Housing Service or their successor organizations and private mortgage insurance as defined in section 2 of the Homeowners Protection Act of 1998 as in effect on December 20 2006. Web Qualified mortgage insurance is mortgage insurance provided by the Department of Veterans Affairs the Federal Housing Administration or the Rural Housing Service and private mortgage insurance as defined in section 2 of the Home-owners Protection Act of 1998 as in effect on December 20 2006.

Web A qualified mortgage insurance premium may be tax-deductible if the mortgage originated after 2006 though there are income limits. 7 Payment of upfront premiums is at the loan issuance. Web As provided in section 163 h 3 E premiums paid or accrued for qualified mortgage insurance during the taxable year in connection with acquisition indebtedness with respect to a qualified residence as defined in section 163 h 4 A of the taxpayer shall be treated as qualified residence interest as defined in section 163 h 3 A.

This means your main home or your second home. Reduced by 10 for each 1000 your adjusted gross income AGI is more than one of these. You can use this method to figure the current year amortization amount to enter in Qualified mortgage insurance premiums paid on post 123106 contracts on the Schedule A screen.

You itemize your deductions. If youre in the 12 tax bracket you. Web Section 163 h 4 E defines qualified mortgage insurance as i mortgage insurance provided by the Veterans Administration VA the Federal Housing Administration FHA or the Rural Housing Administration Rural Housing 1 and ii private mortgage insurance as defined by section 2 of the Homeowners Protection Act.

A recipient need not aggregate mortgage insurance premiums received on all of the mortgages of an individual to determine whether the 600 threshold is met. Web Mortgage insurance premium. Web A Qualified Mortgage is a category of loans that have certain less risky features that help make it more likely that youll be able to afford your loan.

Mortgage insurance helps offset the lenders risk when a borrower makes a small down payment as low down payments increase the amount of money your lender loses if you default on your mortgage lower down payment larger loan. This is known as the ability-to-repay rule. Web Initial Mortgage Insurance Premium IMIP Paid upfront the initial mortgage insurance premium is a flat 2 premium due at the time of closing.

You can use this method to figure the current year amortization amount to enter in Qualified mortgage insurance premiums paid on post 123106 contractson the Schedule A screen. The election to deduct qualified mortgage in-surance premiums you paid under a mortgage insurance contract issued after December 31 2006 in connection with a home acquisition debt that was secured by your first or second home doesnt ap-ply for tax years beginning after Decem-ber 31 2021. The amount of insurance premiums a borrower has paid appears on IRS Form 1098 which the lender sends to the borrower once a year.

Web For you to take a home mortgage interest deduction your debt must be secured by a qualified home. Typically borrowers making a down payment of less than 20 percent of the purchase price of the home will need to pay for mortgage insurance. Web The mortgage is acquisition debt for a qualified residence a new mortgage.

List Of Top Financial Services Companies In Panchmahal Best Finance Companies Justdial

美品 Gianni Versace セットアップ ブラック ダブルボタン Rj4zw2hrvd Www Dr Carmen Mayer De

Mortgage Insurance When Do You Need It New Dwelling Mortgage

Can S Corporations Offer Health Insurance To Employees

美品 Gianni Versace セットアップ ブラック ダブルボタン Rj4zw2hrvd Www Dr Carmen Mayer De

The Ultimate Guide To Disaster Preparedness For Your Finances

5 Types Of Private Mortgage Insurance Pmi

Qualified Mortgage Insurance Premium Definition Example

How Much Does Private Mortgage Insurance Pmi Cost Valuepenguin

Is Mortgage Insurance Tax Deductible Bankrate

Can I Deduct Mortgage Insurance Premiums

Are Fha Mortgage Insurance Premiums Tax Deductible

美品 Gianni Versace セットアップ ブラック ダブルボタン Rj4zw2hrvd Www Dr Carmen Mayer De

Is Mortgage Insurance Tax Deductible

Faqs Get Answers To All Your Banking Finance Related Queries Indusind Bank

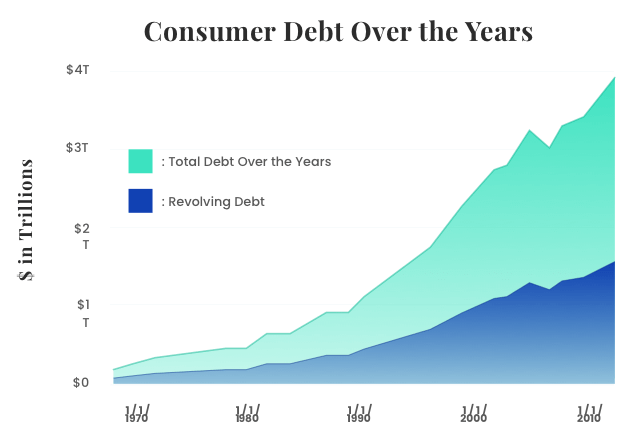

Financial Literacy Guide To Personal Finances

Is Pmi Tax Deductible Credit Karma