Mortgage calculator adding extra payments

Mortgage Calculator exe file - click the link and immediately run the mortgage calculator. Make a note - thats the debt-free date with extra payments.

Extra Payment Calculator Is It The Right Thing To Do

After the COVID-19 crisis the FOMC dropped the Fed Funds Rate to zero and issued forward guidance suggesting they would not lift rates through 2023.

. Extra Mortgage Payments Calculator. Mortgage Closing Date - also called the loan origination date or start date. Note that this not an official estimate.

This is the best option if you are in a rush andor only plan on using the calculator today. Or if you are already making monthly house payments this weekly payment mortgage calculator will calculate the time and interest savings you might realize if you switched from making 12 monthly payments per year to making the equivalent of 13 or 14 payments. About Dates Interest Calculations - In the real world the time between the mortgage origination date and the first payment due date will seldom be equal to the payment frequency.

The resulting amount is the overpayment you must make each month. A title for these calculator results that will help you identify it if you have printed out several versions of the calculator. Bi-weekly payments help you pay off principal in an accelerated fashion before interest has a chance to compound on it.

Our mortgage payoff calculator can show you how making an extra house payment 1050 every quarter will get your mortgage paid off 11 years early and save you more than 65000 in interestcha-ching. Expensive penalty charges can dwarf any savings you make from bi-weekly payments. A reverse mortgage is a loan secured by your home.

Whatever the frequency your future self will thank you. Maintain these additional payments over an extended period of time and youll likely eliminate several years from your term. Lets say you have a 220000 30-year mortgage with a 4 interest rate.

Make more frequent payments. Paying off the auto loan early or adding a prepayment amount each month shortens the period of time that the loan is in place and also decreases the total amount of interest that you will pay on the loan in the long run. This type of loan allows borrowers to access a portion of their equity tax-free without having to make monthly mortgage payments.

Here are the advantages of making extra mortgage payments. To do this take your regular monthly payment and divide it by 12. Your mortgage can require.

Mortgage Calculator zip file - download the zip file extract it and install it on your computer. The more you put down the lower your mortgage payment will be. Easily calculate your savings and payoff date by making extra mortgage payments.

Extra Mortgage Payment Calculator 47. To use the calculator input your mortgage amount your mortgage term in months or years and your interest rate. Viewing Your Results Once you have filled out all your information click on the calculate button to see the side-by-side results for your old loan and the loan with extra payments made.

Use this additional payment calculator to determine the payment or loan amount for different payment frequencies. First Payment Due - due date for the first payment. A mortgage loan or simply mortgage ˈ m ɔːr ɡ ɪ dʒ in civil law jurisdicions known also as a hypothec loan is a loan used either by purchasers of real property to raise funds to buy real estate or by existing property owners to raise funds for any purpose while putting a lien on the property being mortgaged.

Interest-only loans are structured as adjustable-rate mortgagesWe also offer an I-O ARM calculator and a traditional ARM loan calculatorWith interest-only loans homeowners do not build equity in their homes unless prices rise which puts them in a precarious position if house prices fall or when mortgage rates rise. You can pay extra payments to save on the loan interest. In addition to making extra payments another great way to save money is to lock-in historically low interest rates.

This free online calculator will show you how much you will save if you make 12 of your mortgage payment every two weeks instead of making a full mortgage payment once a month. The Early Loan Payoff Calculator is another loan payoff calculator that will help you figure out how much extra to pay each month to pay down the loan by a desired years or months. Since a bi-weekly plan results in 13 annual payments making that extra 13th payment can trigger the penalty.

If you make a down payment of less than 20 the calculator will estimate how much private mortgage insurance PMI you might pay this insurance protects the lender in case you default. Doing so can shave four to eight years off the life of your loan as well as tens of thousands of. SmartAssets award-winning calculator can help you determine exactly how much you need to save to retire.

Found on the Set Dates or XPmts tab. In the early years of a longterm loan most of the payment is applied toward interest. Make Extra House Payments.

At the time of this writing the analysis shows the final payment scheduled for March 1 2042. You can also add extra monthly payments if you anticipate adding extra payments. This calculator will calculate the weekly payment and associated interest costs for a new mortgage.

This is the schedule without any additional payments. Home buyers can shave years off their loan by paying bi-weekly making extra payments. Building a Safety Buffer by Making Extra Payments.

When this happens you can still replicate its payment effect by adding a particular amount to your monthly payments. Adding just one extra payment a month will help you be mortgage-free sooner and save you. Find the balance as of the debt-free date.

Over the course of the year you will have paid the additional month. This calculator allows you to figure the savings by adding an extra amount to your fixed monthly payments the potential savings by making biweekly payments. Learn the benefits and disadvantages of paying off your mortgage faster.

Your mortgage payment is defined as your principal and interest payment in this mortgage payoff calculatorWhen you pay extra on your principal balance you reduce the amount of your loan and save money on interest. Keep in mind that you may pay for other costs in your monthly payment such as homeowners insurance property taxes and private mortgage insurance. You could add 360 extra one-type payments or you could do an extra monthly payment of 50 for 25 years and then an extra monthly payment of 100 for 3 years etc.

It must be your primary residence that means that you as the borrower must live in the home for as long as you have the loan. The loan is secured on the borrowers property through a process. 2020 has been a record year for mortgage originations as many homeowners refinanced to take advance of low.

Now set the extra payments to 0 and look at the schedule. Job kids mortgage payments car payments - the list goes on. This is the best option if you plan on using the calculator many times over the.

The calculator will default to todays date if you enter nothing here. In addition to the standard mortgage calculator this page. There are after all more immediate concerns.

It could be one extra mortgage payment a year two extra mortgage payments a year or an extra payment every few months. How Do Biweekly Mortgage Payments Work. Field Help Input Fields.

You can still boost your mortgage even if you make extra payments after a couple of years on your mortgage. The actual amount will still depend on your affordability assessment which reviews your. Make payments weekly biweekly semimonthly monthly bimonthly quarterly or.

Based on our calculator if you apply for a mortgage with your spouse a lender may grant you a mortgage amount between 211600 to 306600. Instead of paying twice a week you can achieve the same results by adding 112th of your mortgage payment to your monthly payment. Advantages Disadvantages of Biweekly Payments.

Amid this daily grind its easy to put retirement savings on the back burner especially when its 15 20 or 30 years off.

Loan Amortization With Extra Principal Payments Using Microsoft Excel Tvmcalcs Com

Create A Loan Amortization Schedule In Excel With Extra Payments If Needed

Biweekly Mortgage Calculator With Extra Payments Free Excel Template

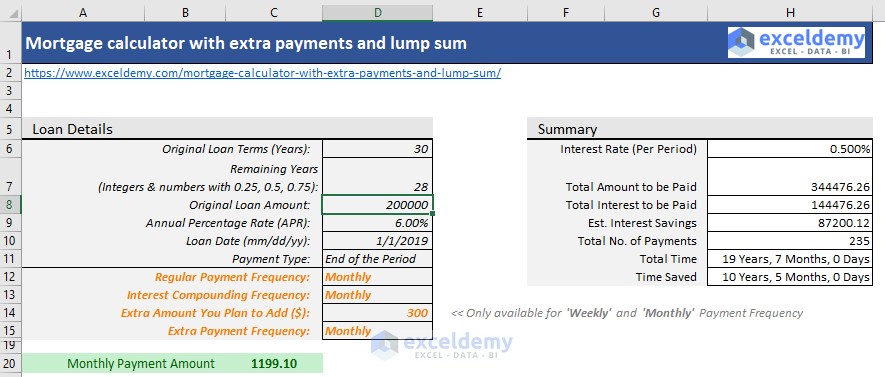

Mortgage Calculator With Extra Payments And Lump Sum Excel Template

Mortgage Calculator With Extra Payments And Lump Sum Excel Template

Mortgage With Extra Payments Calculator

Biweekly Mortgage Calculator With Extra Payments Free Excel Template

Downloadable Free Mortgage Calculator Tool

Mortgage Repayment Calculator

Extra Payment Calculator Is It The Right Thing To Do

Downloadable Free Mortgage Calculator Tool

Download Microsoft Excel Mortgage Calculator Spreadsheet Xlsx Excel Loan Amortization Schedule Template With Extra Payments

Loan Amortization With Extra Principal Payments Using Microsoft Excel Tvmcalcs Com

Excel Mortgage Calculator How To Calculate Loan Payments In Excel

Biweekly Mortgage Calculator With Extra Payments Free Excel Template

Extra Payment Calculator Is It The Right Thing To Do

Extra Payment Mortgage Calculator For Excel